Supporting Our Seniors: A Closer Look at the Budget 2026 Initiatives

As Singapore’s population continues to age, the government is taking proactive steps to ensure that our seniors can enjoy their golden years with dignity, security, and peace of mind. Budget 2026 introduces several key measures aimed at strengthening the support network for the silver generation, focusing on both immediate financial needs and long-term care sustainability.

Enhancing Long-Term Care and Direct Financial Support

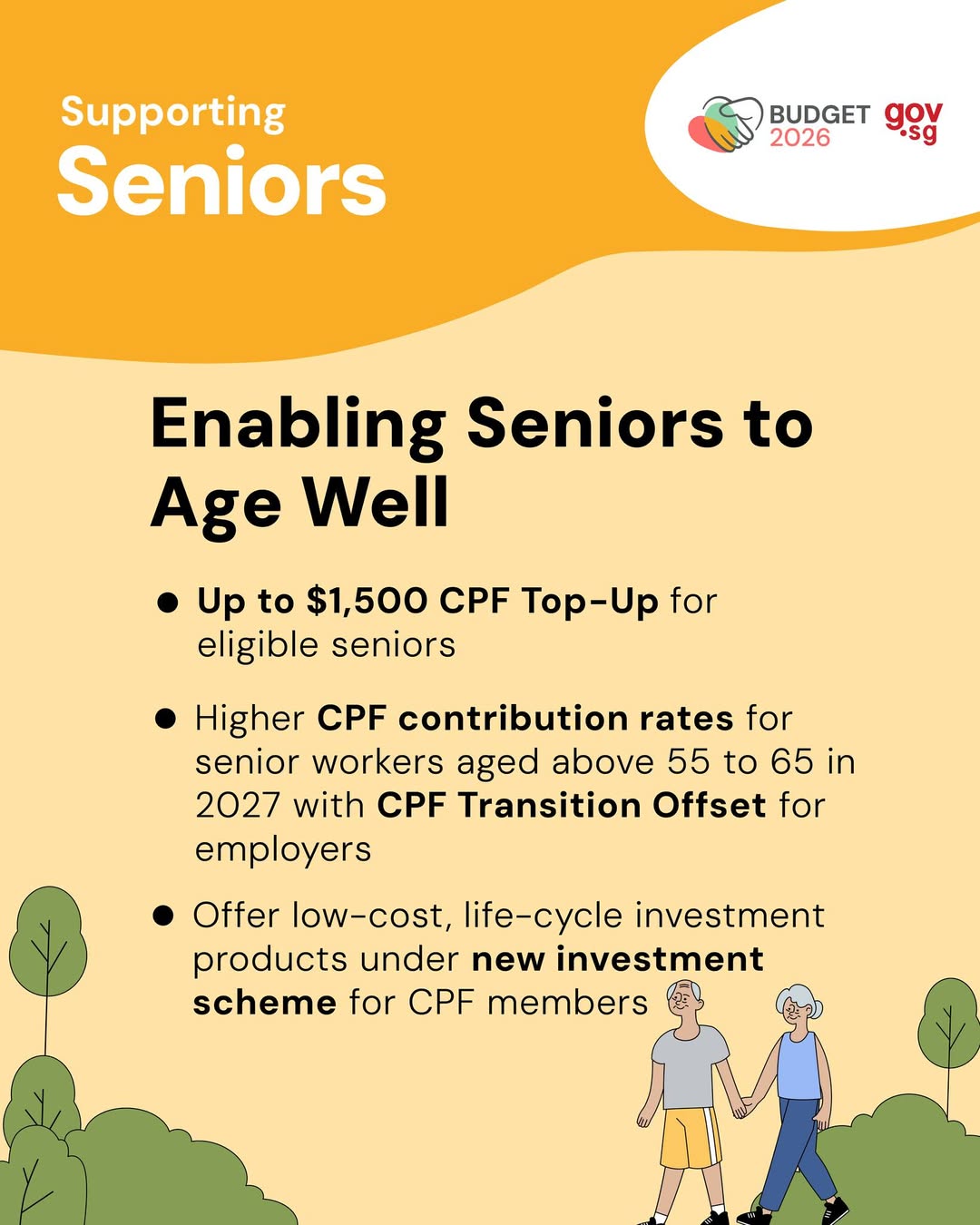

To ensure that high-quality care remains accessible for all, a significant $400 million top-up will be made to the Long-Term Care Support Fund. This funding is crucial for maintaining the infrastructure and services required to support seniors as their needs evolve over time. In addition to systemic support, eligible seniors will benefit from a direct CPF top-up of up to $1,500, providing a helpful boost to their personal retirement savings and helping to manage the cost of living.

Investing in the Future of Retirement

Recognizing the value of senior workers in the economy, Budget 2026 outlines an increase in CPF contribution rates for older employees. This move is designed to help workers build more substantial nest eggs during their later working years. To assist businesses during this shift, the government will provide a CPF Transition Offset for employers, ensuring that the transition remains sustainable for the labor market. Furthermore, a new investment scheme will be launched for CPF members, offering fresh opportunities to grow retirement savings and achieve greater financial independence.